Business & Tech Essentials

Learn, Analyze, Empower

Videos for smarter business and data insights

Discover practical insights and daily learning content across key business applications like D365, Power BI, SharePoint, and more.

Enhance decision-making, boost collaboration, and stay ahead in today’s dynamic work environment.

Microsoft D365

Power BI

Share Point

BootCamp

TechX

How to Connect Your Business Central with Visual Studio Code

Welcome to our next class on Dynamics 365 Business Central. Today we will learn how to connect Business Central with Visual Studio Code so you can begin developing and customizing extensions using AL language. This lesson is written for developers at all skill levels including beginners, junior developers, system administrators, and learners who want to work with Business Central in a structured development environment using the latest Microsoft development workflow recommended for 2026 and beyond. We will explore the official Microsoft setup steps, including installing the essential AL Language extension, setting up your launch.json and app.json files, and running your first AL code inside Business Central. By the end of this lesson you will also understand how modern AI tools can be used to increase your productivity in AL development.

Before we begin, many businesses ask why this setup is important. In real development projects, you will write AL code inside Visual Studio Code to create custom pages, tables, extensions, fields, and automation workflows. This is the foundation of Business Central development and the starting point of every Dynamics 365 BC project.

If your organization needs help with sandbox configurations, app deployment, or full feature development, our Microsoft Dynamics 365 Solutions team at Out2Sol Global provides complete support from installation to project publishing.

Watch Our Out2Sol Short and Quick Youtube Video

We always start this class by asking our students to watch a short tutorial video.

Here is the same video we used in our training session

Watching it once will make the step-by-step process below easy to follow.

Steps to Connect Visual Studio Code with Business Central

Below are the steps in the same teaching style used in a classroom. Each step is short and clear.

Step 1 Download Visual Studio Code

-

Install Visual Studio Code on your computer

-

Open Visual Studio Code and wait until it loads fully

-

This editor becomes your main workspace for AL development

Step 2 Install AL Language Extension

-

Open the Extensions view in Visual Studio Code

-

Search for the AL Language extension

-

Install the AL Language extension for Microsoft Dynamics 365 Business Central

-

This extension prepares Visual Studio Code for AL coding

Step 3 Open Command Palette

-

Select View inside Visual Studio Code

-

Click Command Palette

-

You will use Command Palette often for AL commands

Step 4 Select AL Go

-

Type AL Go inside the Command Palette

-

Choose AL Go to create a new AL project

-

Visual Studio Code generates a starter folder with sample files

Step 5 Select your wave

-

Choose the wave that matches your Business Central environment

-

In class we select Wave 2

-

Select the same wave used by your sandbox for correct compatibility

Step 6 Choose server

-

You may choose your own server

-

You may choose Microsoft cloud sandbox

-

Learners usually work with cloud sandbox because it is pre configured and stable

Step 7 Copy application ID or URL

-

Open your Business Central application

-

Copy the application ID or URL

-

You will use this value in your project configuration later

Step 8 Edit launch json

-

Open launch json inside the AL project

-

Update these fields

-

name

-

tenant

-

environmentType

-

environmentName

-

startupCompany

-

-

These values guide Visual Studio Code to your Business Central environment

Step 9 Download symbols

-

Open Command Palette again

-

Search for the symbols option

-

Select the command to download symbols from Business Central

-

Symbols allow Visual Studio Code to read pages tables fields and other base objects

Step 10 Update app json

-

Open app json inside your AL project

-

Update the id field

-

Update the name field

-

Update the publisher field

-

These fields identify your extension inside Business Central

Step 11 Copy the sign in link

-

Visual Studio Code shows a link after symbols download

-

Copy the link

-

Open it in your browser

Step 12 Enter the verification code

-

A Microsoft page opens

-

Enter the code that appears inside Visual Studio Code

-

Select next to continue

Step 13 Sign in to Business Central

-

Sign in using your Business Central account

-

Authentication completes when your credentials match the environment

-

This process connects your AL workspace to the server

Step 14 Confirm the developer connection

-

A confirmation page tells you that your developer application is connected

-

Close the page and return to Visual Studio Code

Step 15 Edit the Hello World file

-

Open the HelloWorld al file

-

Change the message from Hello world to Hello to all of Youtube

-

This is your first custom AL message

Step 16 Run without debugging

-

Select Run without debugging

-

The project compiles and publishes to your Business Central sandbox

-

Visual Studio Code opens the Business Central web client when the publish completes

Step 17 View your message inside Business Central

-

A pop up message appears

-

The message displays Hello to all of Youtube

-

Select ok

Step 18 Check your extension list

-

Open the Extensions page inside Business Central

-

Your extension appears in the list

-

This confirms that Business Central is connected to Visual Studio Code successfully

Using AI Tools with Business Central Development in Visual Studio Code

As development practices evolve, 2026 brings new ways to build and maintain Business Central solutions more efficiently. Once you have connected Visual Studio Code with your Business Central sandbox and downloaded the required symbols, developers can enhance their workflow using AI-enabled tools that integrate directly into VS Code. These tools are designed to assist you with code suggestions, patterns, and project navigation, making AL development faster and less error-prone.

Here are the key AI-enabled tools commonly used in 2026:

GitHub Copilot Integration

GitHub Copilot can be added to VS Code to provide real-time code suggestions and completions while you write AL code. It learns from context and suggests object definitions, function structures, and even comments based on your current workflow. It requires a GitHub Copilot subscription and is best used by developers who understand core AL syntax and Business Central architecture.

AI-Assisted Extensions for Code Recommendations

Several extensions built on AI models can scan your AL files and suggest improvements, refactoring opportunities, or help you catch potential issues early. These tools work alongside the AL Language extension from Microsoft and do not replace your expertise. Instead they act as a smarter guide that helps you avoid common mistakes.

Microsoft Foundry and Model Integration

For advanced scenarios, developers can integrate AI models through Microsoft Foundry or related AI platforms to automate certain parts of their development or testing workflows. These models can assist in generating boilerplate code, offering test suggestions, or preparing documentation based on your project files.

Accessing AI Tools Within the VS Code Workflow

All AI enhancements are made available through the Command Palette (Ctrl + Shift + P) or dedicated sidebars within Visual Studio Code. After you set up your project using the steps earlier in this class (refer to the setup steps), you can invoke AI-related commands alongside traditional AL commands like AL: Go! or Download Symbols.

Why This Matters in 2026

The integration of AI tools into the Business Central development cycle means:

• You spend less time on repetitive tasks

• You reduce syntax and structural errors

• You gain contextual code guidance

• You can focus more on business logic and customization

AI tools do not replace developer expertise but improve efficiency. Using AI appropriately allows you to produce higher-quality AL code and maintain Business Central solutions more effectively in 2026.

Important Notes for Learners

These files are used in every AL project

-

launch json

-

app json

Launch json controls

-

tenant

-

environment type

-

sandbox name

-

startup company

App json controls

-

extension id

-

extension name

-

publisher name

Symbols help Visual Studio Code recognise

-

standard tables

-

standard pages

-

fields

-

base application objects

If symbols do not download the environment and Visual Studio Code cannot work together.

Visual Studio Code Business Central Setup Advice

Learners commonly face setup interruptions during the first attempt. You can avoid many issues with a steady approach.

-

Always use the correct wave version

-

Keep your tenant value accurate

-

Use a stable internet connection

-

Use the AL extension version that matches your Business Central build

-

If you use a sandbox created recently wait for a few minutes before downloading symbols

-

Never copy values from another student because tenant values must match your own account

Troubleshooting Common Issues

Here are frequent issues students face in labs.

Symbols do not download

-

Wave does not match server version

-

Sandbox version recently updated

-

Tenant value incorrect

-

AL Language extension not updated

Publishing fails

-

Incorrect environment type in launch json

-

Outdated AL extension

-

Incomplete authentication

Login issues

-

Wrong account

-

Multi factor prompt not completed

-

Cached credentials expired

Why This Setup Matters

A working Visual Studio Code and Business Central connection supports practical development. All AL code is created and tested inside this environment. You use it for

-

pages

-

tables

-

fields

-

automation steps

-

small extensions

-

custom calculations

This early setup builds the confidence needed for advanced tasks. A clean sandbox environment helps learners experiment safely before touching live data.

Final Notes for Students

After completing this lesson try these small tasks to build confidence

-

create a second AL project with a new name

-

change the message text in each project

-

test symbol download again

-

explore the objects inside the base application through Visual Studio Code

-

publish your project again and observe the change in the Extensions list

Using these tasks your learning path becomes clear. Learners continue to grow through consistent practice. For teams working with Microsoft Dynamics 365 solutions this foundation prepares the structure needed for future customisation work.

How to Open New Accounting Period in D365 Business Central

Welcome to our next class on D365 Business Central. We will walk through how to open new accounting period in Business Central in a clear step by step method. We will also watch a short and quick tutorial video, from which you can use while following these steps for hands on practice. This lesson is designed for accountants’ bookkeepers and system administrators who manage financial periods and reporting period setup in Business Central.

For expert support consider our Microsoft Dynamics 365 Services and Solutions to streamline your setup and ensure best practices.

In this lesson we explain how to open new accounting period and we show how the creation of accounting period affects reporting period filters and financial reports also tips and tricks, closing period, common issues & their solutions and in the last practical exercise for our students.

Why Opening Accounting Periods Matters for Your Company

Before we start the practical steps let us agree why you should open new accounting period in a timely and correct way. Accounting period setup determines the date ranges that Business Central uses for reporting period filters and for closing revenue balances at year end. If accounting periods are not created correctly financial reports may show incorrect results and some closing tasks will not work as expected.

Opening a reporting period on time also reduces manual adjustments speeds up month end closing and improves the reliability of management reports. When periods are defined clearly teams processing invoices and reconciliations know exactly which period to post to and this supports smooth month end workflows.

Quick Overview of The Screens and Tools We Will Use

We will use the Accounting Periods page inside Business Central and the Process actions available there. The main actions you will use are Create Year Close Year and if needed Reopen Fiscal Period. You can create periods in bulk with Create Year or create them manually when the periods follow a non-standard pattern.

Step By Step Guide to Open New Accounting Period in D365 Business Central

Follow these steps while watching your tutorial video. I will list each step and then add teacher notes and tips for each step so you learn not only what to do but why to do it.

Quick and Short Video of How to Open New Accounting Period in D365 Business Central

Read Quick and Easy Steps

- Step 1. > Use the Tell Me search feature and search for Accounting Periods then open the Accounting Periods page

Teacher note: I have found using the Tell Me search is fastest for new users. Type Accounting Periods in the search box and click the page link that appears. - Step 2. > Review existing periods on the Accounting Periods page

Teacher note: Check the latest fiscal year listed the last created period and whether any periods are Closed or Date Locked. This helps you avoid overlaps or accidental changes to closed periods. If you already have an open fiscal year confirm its end date to plan the next year start date. - Step 3. > Decide whether to create the year in bulk or create periods manually

Teacher note: Use Create Year when you want a standard set of periods such as 12 monthly periods. Choose manual creation if you need irregular period lengths such as a 4 4 5 retail calendar. Business Central supports both methods. - Step 4. > If using Create Year choose Process then Create Year and fill the fields Starting Date No of Periods and Period Length then press OK

Teacher notes: for a standard calendar fiscal year set Starting Date to the first date of the year and No of Periods to 12 and Period Length to 1M. The system will generate the full set of periods automatically which saves time and reduces errors. - Step 5. > If creating periods manually choose New and enter each period starting date and mark New Fiscal Year for the first period of the year then repeat for remaining periods

Teacher note: Manual creation is useful when your periods differ in length. When you set New Fiscal Year on the first period Business Central knows this is the year boundary and will use it in closing procedures. - Step 6. > Verify the Created periods appear with correct start dates names and fiscal year flags

Teacher note: Names default to month names but you can change names if needed for clarity. Confirm there are no gaps or overlaps between periods. For example, ensure one period ends the day before the next period start date. - Step 7. > For reporting locked periods set Date Locked or Closed where required after review with finance owners

Teacher Note: Use Date Locked to prevent changing starting dates and closed to indicate the period is shut for postings. Always coordinate with accounting owners before locking or closing periods. Closed periods cannot be reopened without using the Reopen Fiscal Period action and you should understand the implications before closing. - Step 8. > Run a quick posting test in a sandbox or test company to confirm reporting filters behave as expected

Teacher note: Post a small test entry in the new period and run a simple report or ledger inquiry to confirm Business Central recognizes the posting in that reporting period. This reduces surprises during month end.

Helpful Teacher Tips and Tricks for A Smoother Process

- Tip 1: Keep a consistent naming and starting date convention for all fiscal years. Consistency reduces confusion and makes it easier to write column definitions in financial reports that rely on accounting period setup.

- Tip 2: Use Create Year for standard months to save time. If your company uses standard months Create Year creates all periods in seconds and avoids manual entry errors.

- Tip 3: Maintain at least one open fiscal year at all times. Business Central requires at least one open fiscal year. When you plan to close a year ensure the next year is already created. This prevents system errors when closing and when running reports.

- Tip 4: Use Date Locked with care and communicate changes clearly to posting users. Date Locked prevents changing the start date for a period. Communicate to the team when you will lock dates to avoid blocked transactions.

- Tip 5: Test changes in a sandbox before applying them in production. Always validate period creation and report behavior in a test environment if possible. This protects live data and gives you confidence before updating production.

- Tip 6: Document your period setup steps and keep a short guide inside your internal IT or accounting handbook. A short-documented process helps new staff follow the same method and maintains continuity if a team member is absent.

How To Close a Fiscal Year and The Effects on Reporting Period in Accounting

Closing a fiscal year is part of your period management workflow. On the Accounting Periods page choose Process then Close Year to close the earliest open fiscal year. Closing marks the periods as Closed and Date Locked which prevents further changes and finalizes the year for reporting. Note that after a year is closed you cannot change the starting date of the following year so plan carefully before closing.

Out2Sol Professional notes: If you close a year without creating the next year first you may run into processing issues. Always ensure continuity by creating the next fiscal year before closing the current one.

How To Reopen Fiscal Periods If Required

There are situations when you may need to reopen a period for adjustments. Business Central provides a Reopen Fiscal Period action that reopens the last closed fiscal period. Use this action with full awareness of the consequences and communicate with auditors and finance owners. Reopening should be a controlled process with approvals and audit notes.

Practical Classroom Exercise I Have for You

Exercise 1: Follow the video and perform these tasks in a sandbox environment.

- Create a new fiscal year using Create Year set Starting Date to the first date of your next fiscal year No of Periods to 12 Period Length to 1M and press OK.

- Post a small journal entry dated inside one of the new periods and run a balance inquiry to confirm reporting filters pick up the posting.

- Mark the first period Date Locked and try to change the Starting Date to see the protection in action then undo the change.

Exercise 2: Manual setup exercise for irregular calendars.

- Create three periods manually with different lengths and confirm Business Central accepts the non-standard setup.

- Run a sample financial report that uses column definitions by accounting period and verify output matches the expected date ranges.

Common Issues and How to Solve Them

Issue Users cannot create a new year because an earlier year is still open or conflicting dates exist

Fix Check the Accounting Periods page for overlapping dates and either create the next year or close the earlier year after ensuring the next year exists.

Issue Postings are not appearing in reports after creating periods

Fix Confirm the posted entries are within the start and end dates of the new accounting period and that the report column definitions are configured to use accounting period filters. Run a test posting and confirm with a ledger inquiry.

Issue Reopening a period is blocked or warns of consequences

Fix Use Reopen Fiscal Period only after obtaining approvals and check which periods were closed most recently to reopen the correct one. Document the reason for reopening for audit purposes.

How This Lesson Ties to Your Reporting and Month End Tasks

When you open new accounting period in Business Central and keep periods accurate your reporting period in accounting becomes reliable. Column definitions in financial reports depend on accounting periods and comparisons between periods use the same period definitions. Correct period setup simplifies variance analysis and shortens time to close month end.

Closing Course and Next Steps

Welcome to the end of class. We have learned how to create and open new accounting period in D365 Business Central using both the Create Year batch job and manual creation. I recommend you practice these steps in a sandbox environment watch our New Accounting Period Open 2025 video and then perform the exercises I provided.

Key Takeaways

- Creating new accounting periods correctly is essential for accurate reporting and smoother month end close.

- Use the Create Year process when you have standard monthly periods to save time and avoid errors.

- Manual period creation is useful for non-standard calendars and gives full control over dates and fiscal year flags.

- Always test period creation in a sandbox and validate reports with a small test posting.

- Keep a documented checklist and coordinate with finance owners before locking closing or reopening periods.

Disclaimer: All logos, trademarks, and brand names used in this document are the property of their respective owners. Their use here is for identification purposes only and does not imply endorsement.

How to Import Data Using Configuration Packages in D365 Business Central

Welcome to our next class on Microsoft Dynamics 365 Business Central. Today, we will explore one of the most useful tools for data migration and setup, how to import data using business central configuration packages.

In this class, we'll walk through each step carefully so that you can easily understand how to manage, edit, and apply imported data in Business Central. This lesson is especially helpful for accountants, system administrators, and consultants who regularly work with data import tasks in D365.

At Out2Sol, we offer Microsoft Dynamics 365 Services and Solutions designed to streamline your business operations; from D365 implementation and integration to advanced customization and training.

Now, let's get started with our step-by-step guide to importing data using configuration packages in Business Central.

Step-by-Step Guide to Import Data Using Configuration Packages

Watch Our Youtube Video

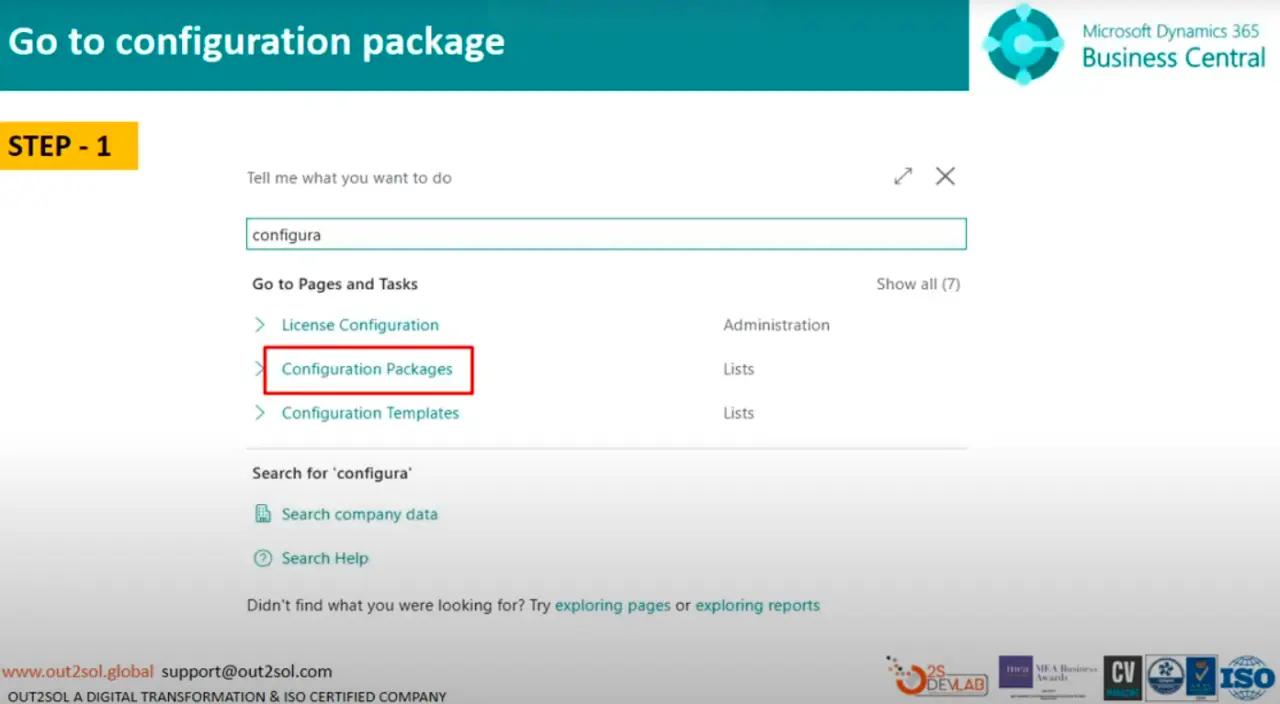

Step 1: Go to Configuration Packages

From the search bar, type Configuration Packages and open the page. This section allows you to create, edit, and manage your data import templates.

Tip: Bookmark this page for quick access in future data import tasks.

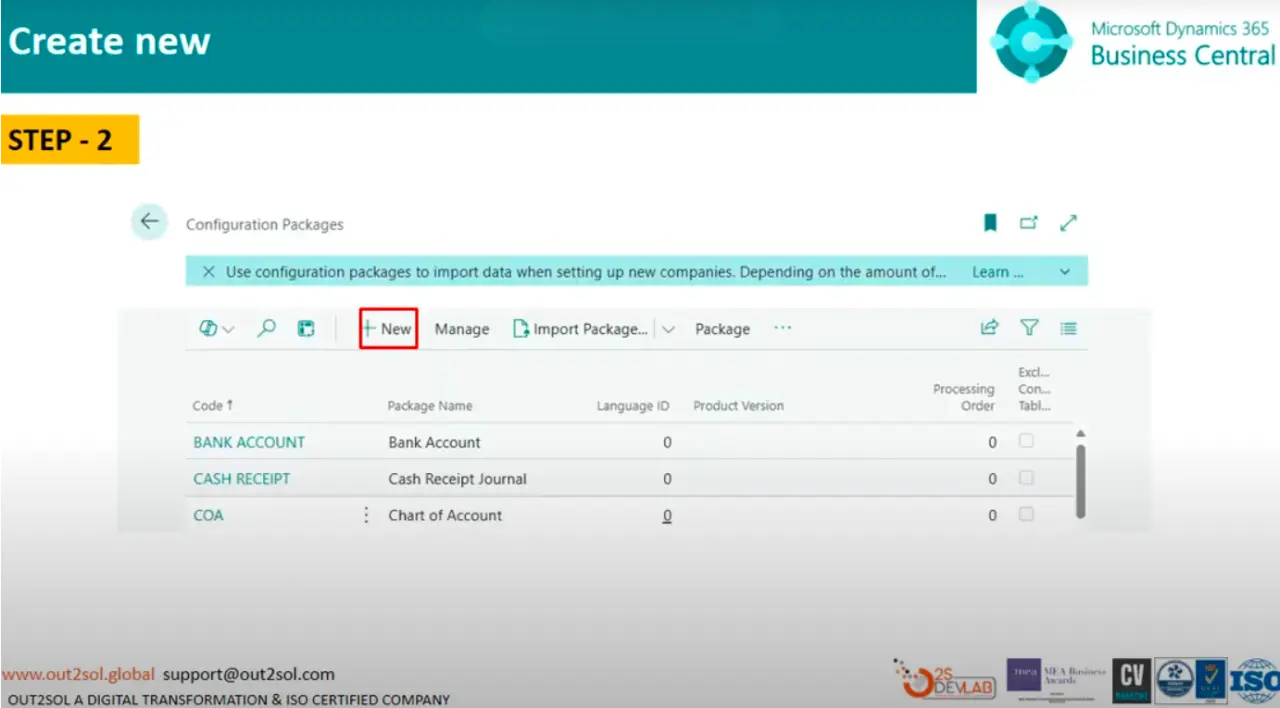

Step 2: Create a New Package

Click on New to create a fresh configuration package.

Tip: Always name your packages clearly, for example, Purchase_Invoice_Import_2025, to avoid confusion later.

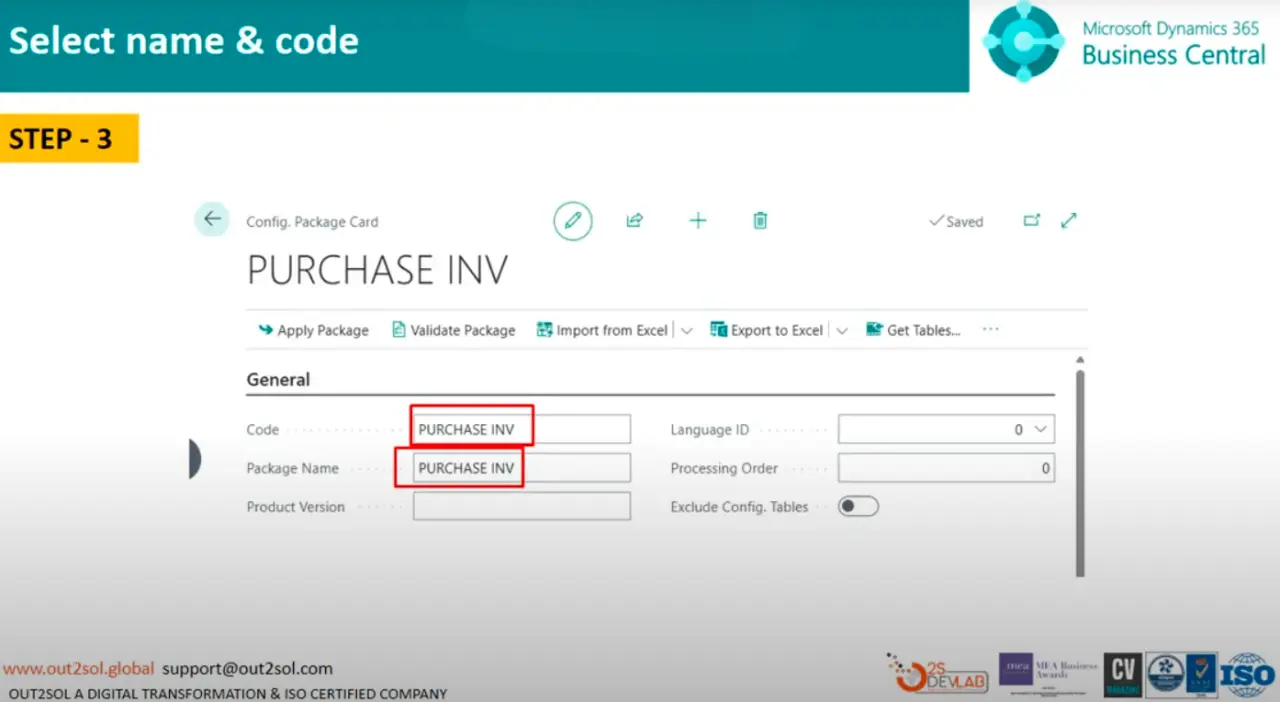

Step 3: Select Code and Package Name

Choose an appropriate Code and Package Name. For this example, we will use Purchase Invoices.

This tells Business Central which area or data type you'll be importing.

Step 4: Select Table ID and Name

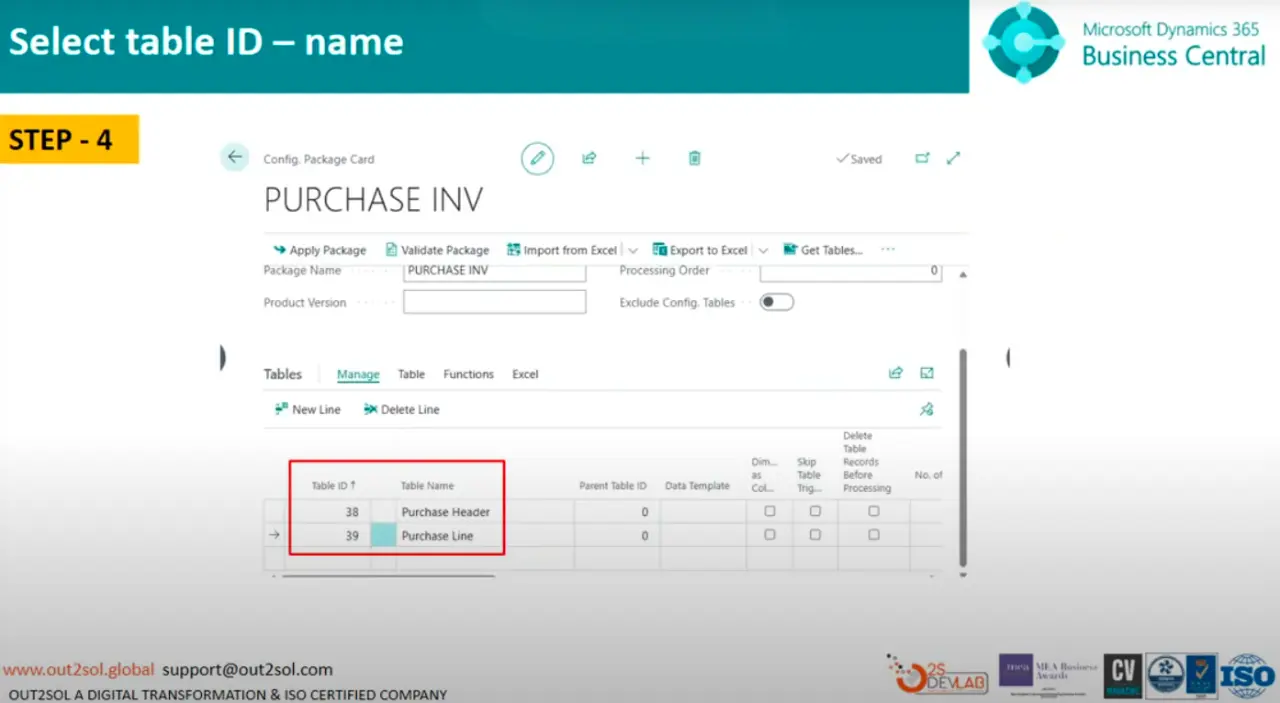

In this step, select the Table ID and Table Name.

For our example, choose Purchase Header and Purchase Line.

Tip: Always double-check your table selection, incorrect tables may cause import errors or data mismatches.

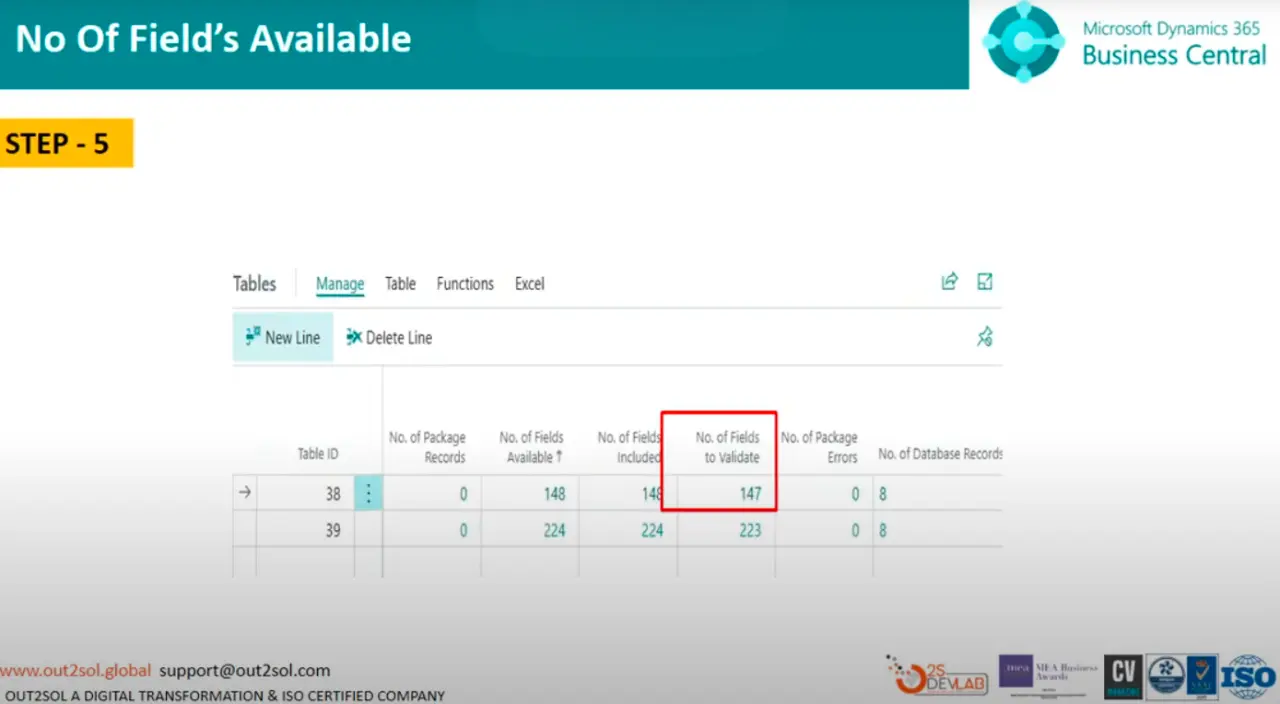

Step 5: Click on Numbers of Fields to Validate

Select No. of Fields to Validate to ensure that the data you're importing matches your table's structure.

This validation step helps prevent data corruption or mapping errors.

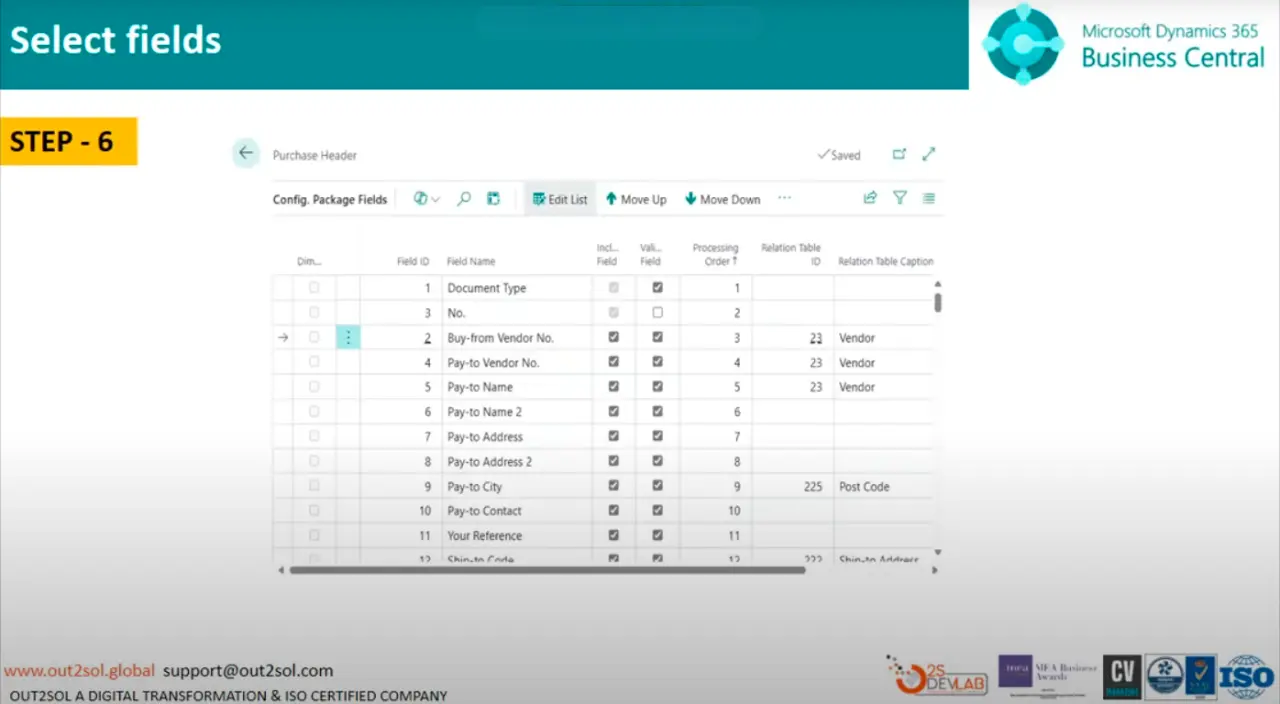

Step 6: Select Fields

Click on Fields to review or modify which fields will be included in your import.

Tip: Import only the necessary fields to keep the data clean and focused.

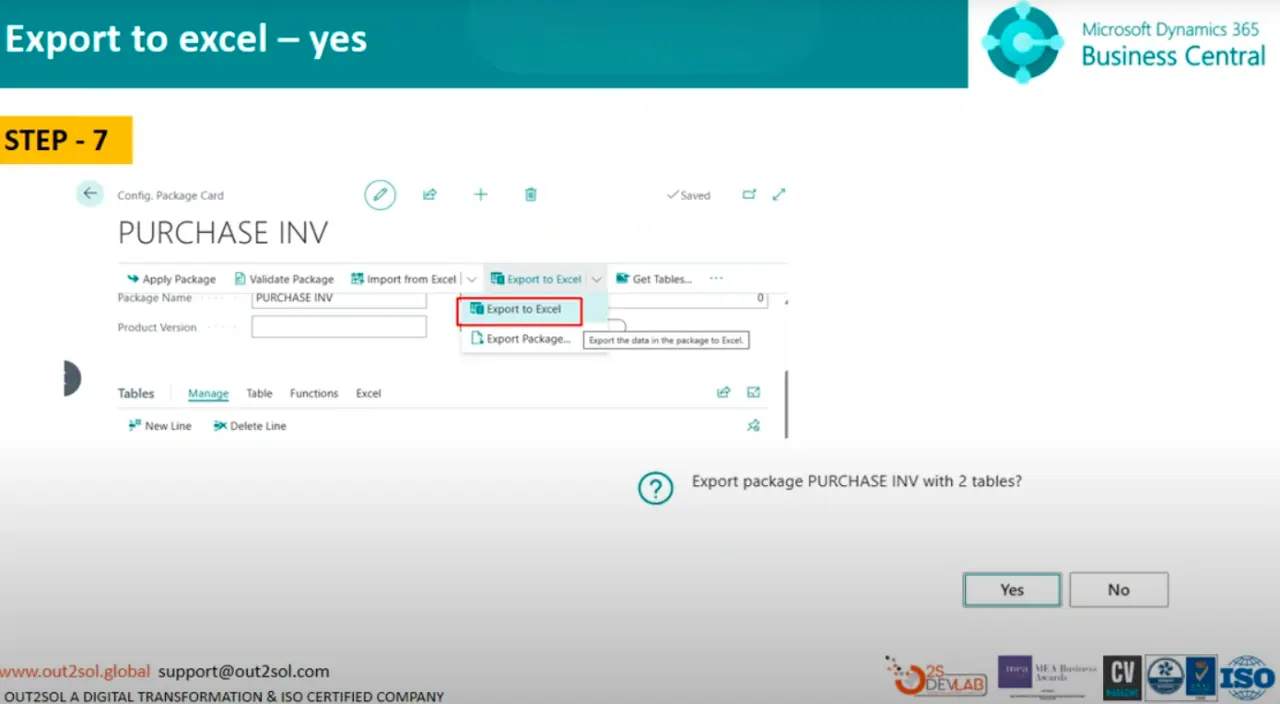

Step 7: Export to Excel

Click Export to Excel. A message will appear:

Export package Purchase Invoice with 2 tables.

Click Yes to proceed.

Business Central will generate an Excel file containing your table structure.

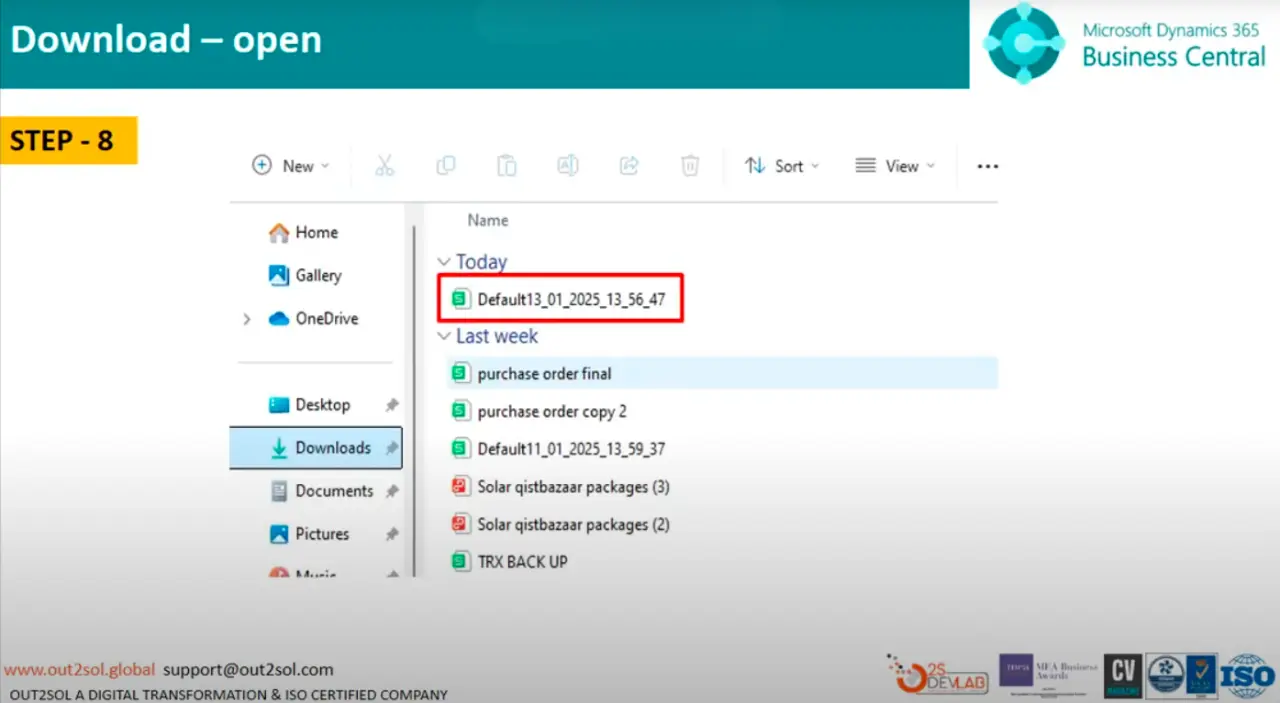

Step 8: Download and Open the Excel File

After downloading, open the Excel file. You'll notice sheets for Purchase Header and Purchase Line — these represent your data structure.

You can now add or modify data in Excel before importing it back into Business Central.

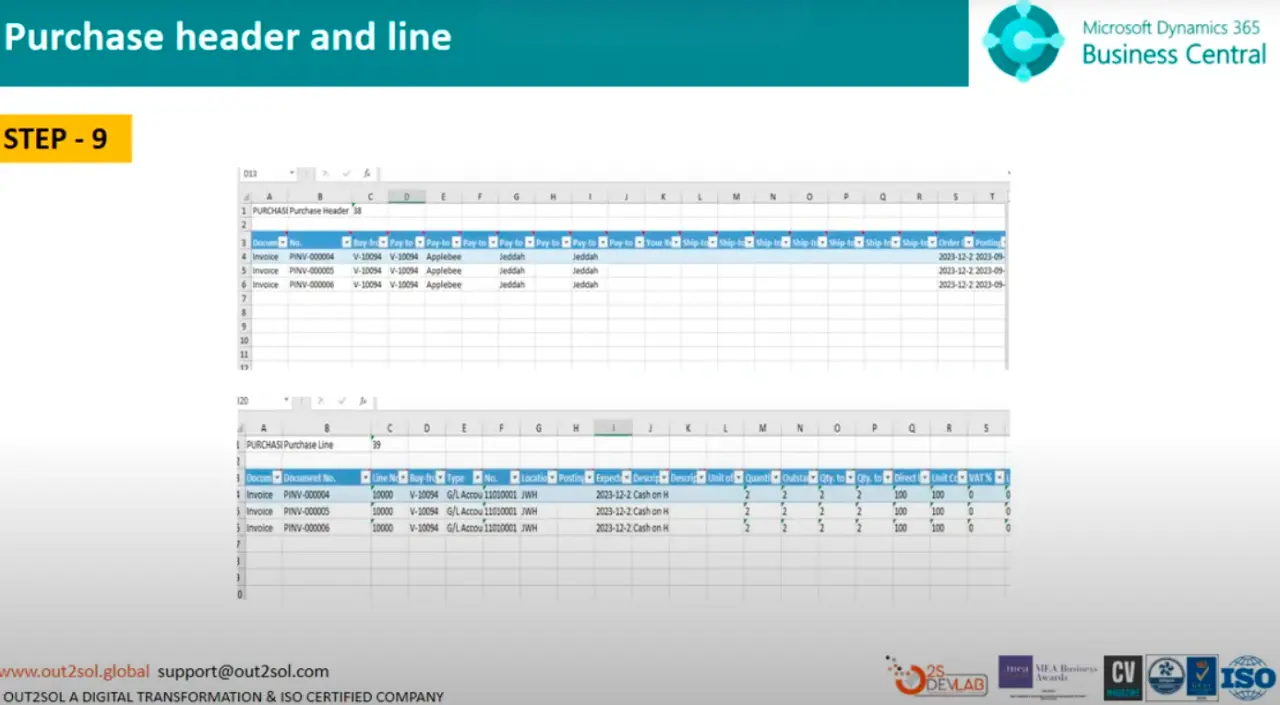

Step 9: Fill Purchase Header and Line Data

Enter the relevant data for your Purchase Header and Purchase Line directly into the Excel file.

Make sure the headers remain unchanged to avoid import issues.

Tip: Keep your data consistent with existing setups (vendor names, item codes, etc.).

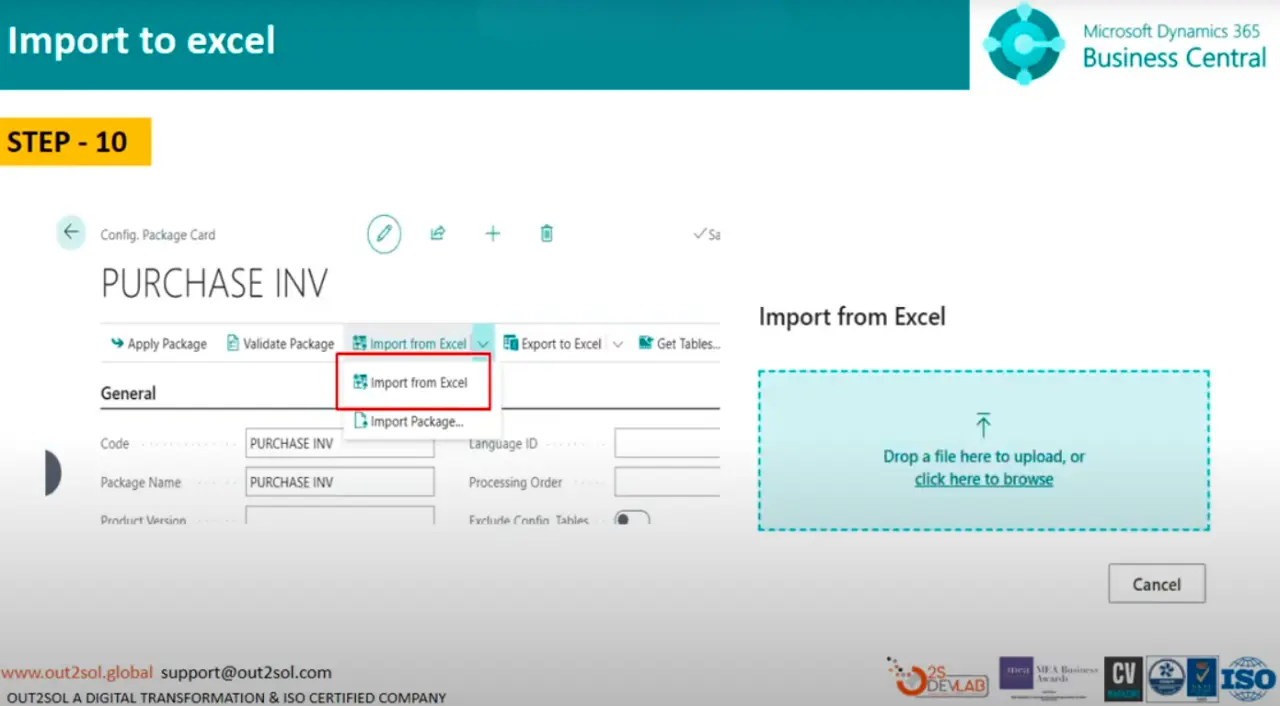

Step 10: Import the File

Once your Excel file is ready, return to Business Central and click on Import from Excel.

Drag and drop your Excel file into the import window.

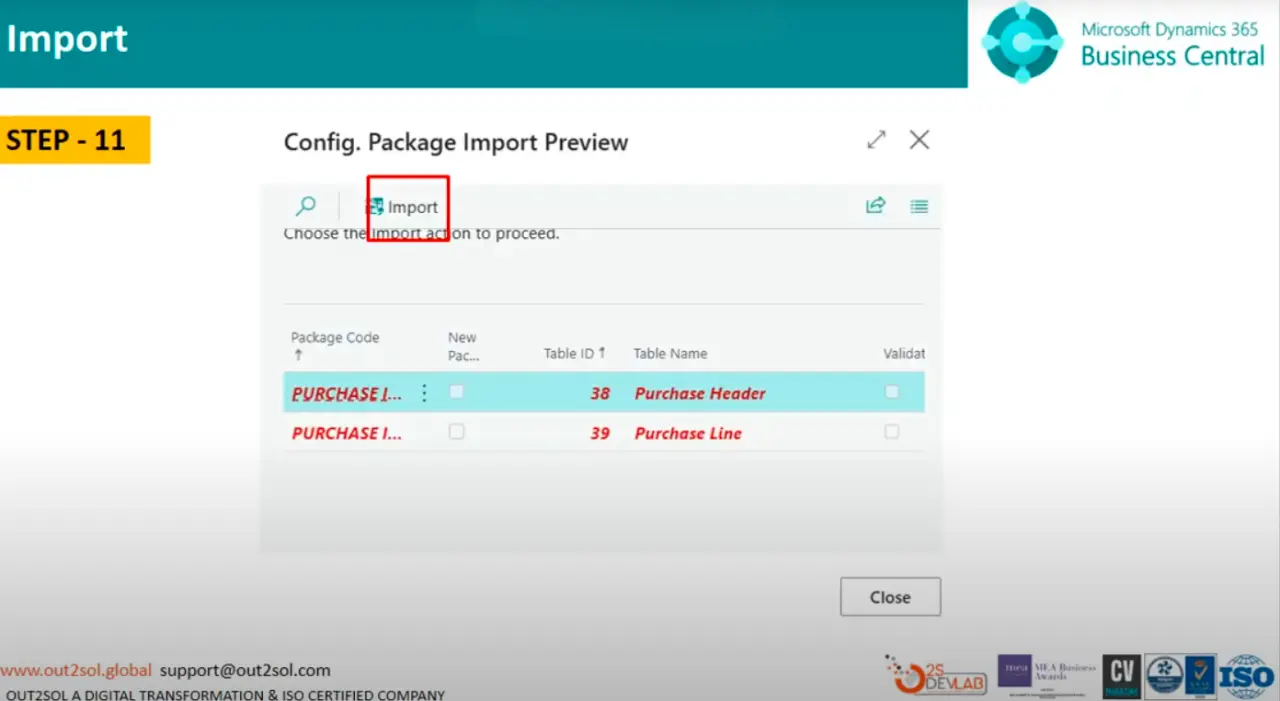

Step 11: Confirm Import

After uploading, click Import. Business Central will process your file and show how many records are ready for application.

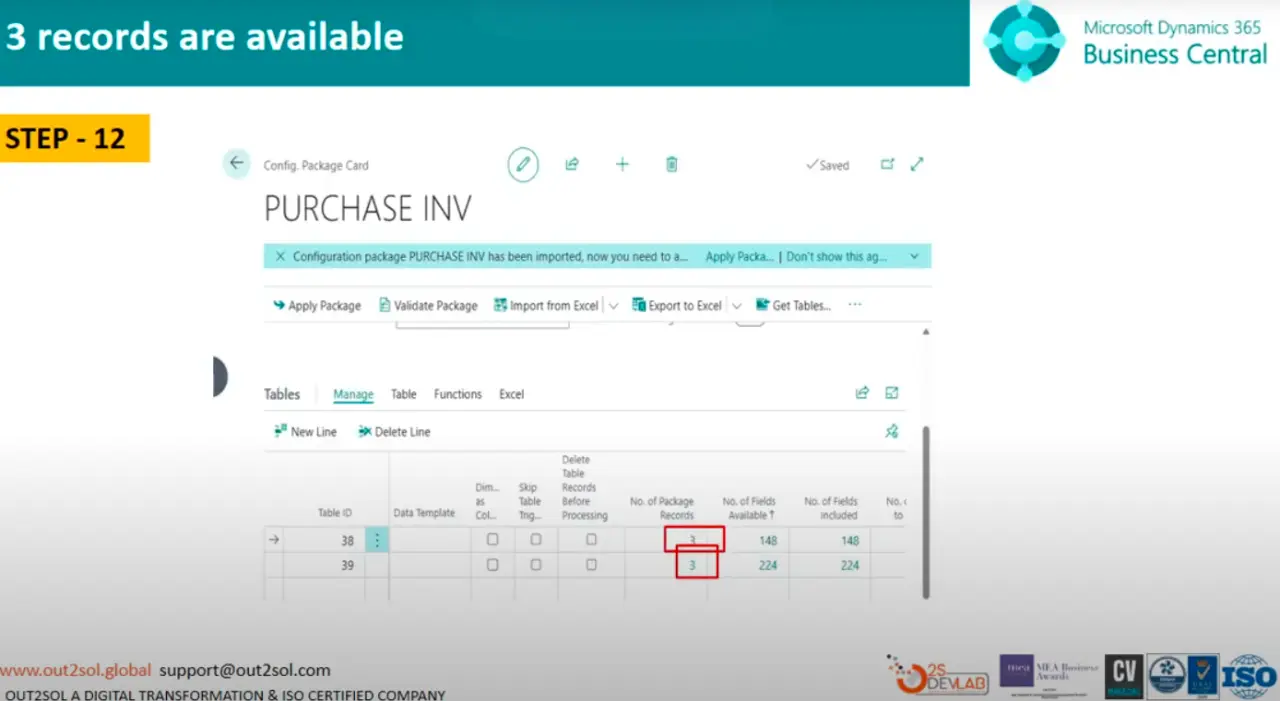

Step 12: Review Imported Records

A message will confirm something like:

3 records are available.

Check the details to ensure your imported data looks correct before applying it.

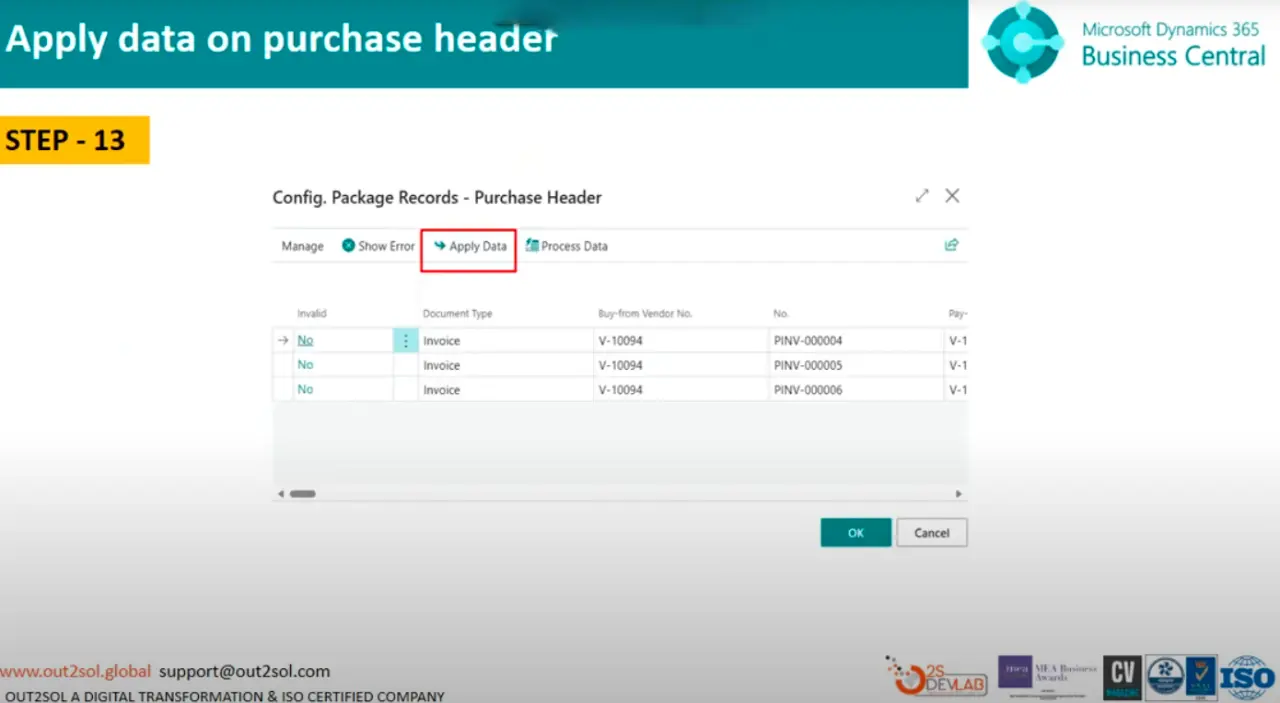

Step 13: Apply Data to Purchase Header

Select Apply Data on the Purchase Header section, then click OK.

This step will map and insert the data into your database.

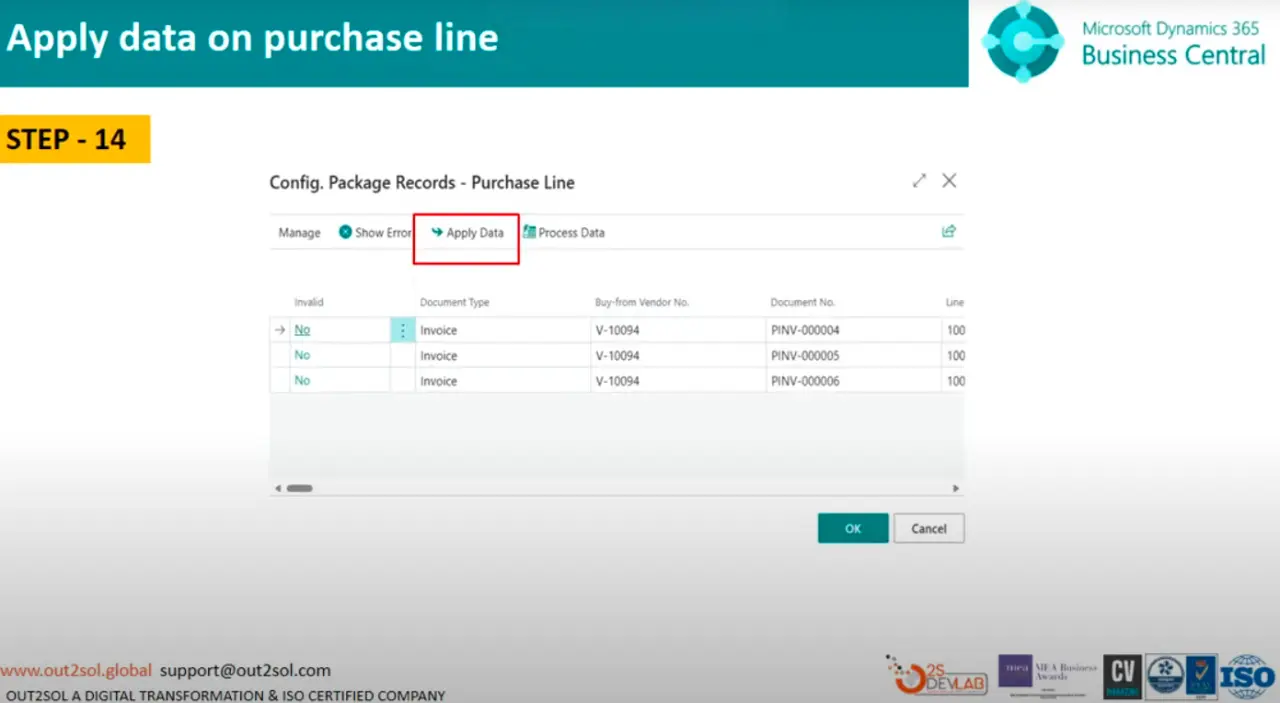

Step 14: Apply Data to Purchase Line

Repeat the process,select Apply Data for Purchase Line, then click OK.

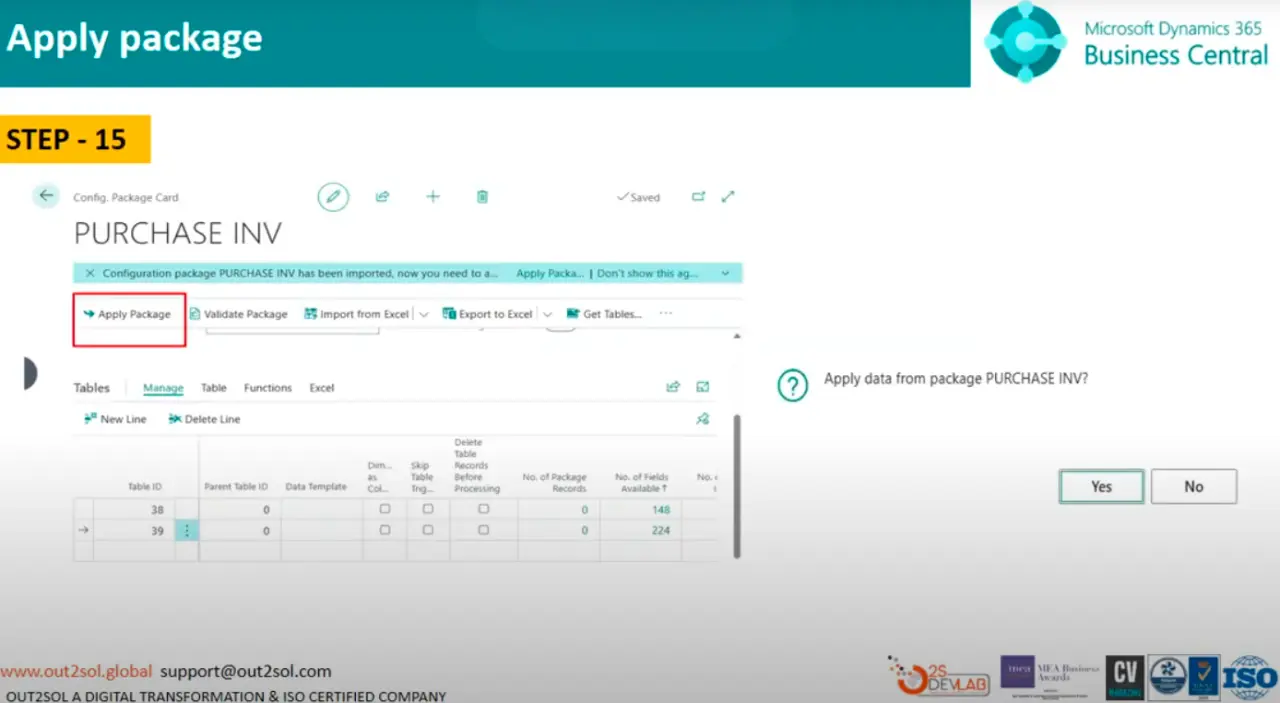

Step 15: Apply the Package

Now click Apply Package.

You'll see a pop-up message:

Apply data from package INV in purchase line.

Click Yes to confirm.

This applies your imported data to the respective tables.

Step 16: Verify the Imported Data

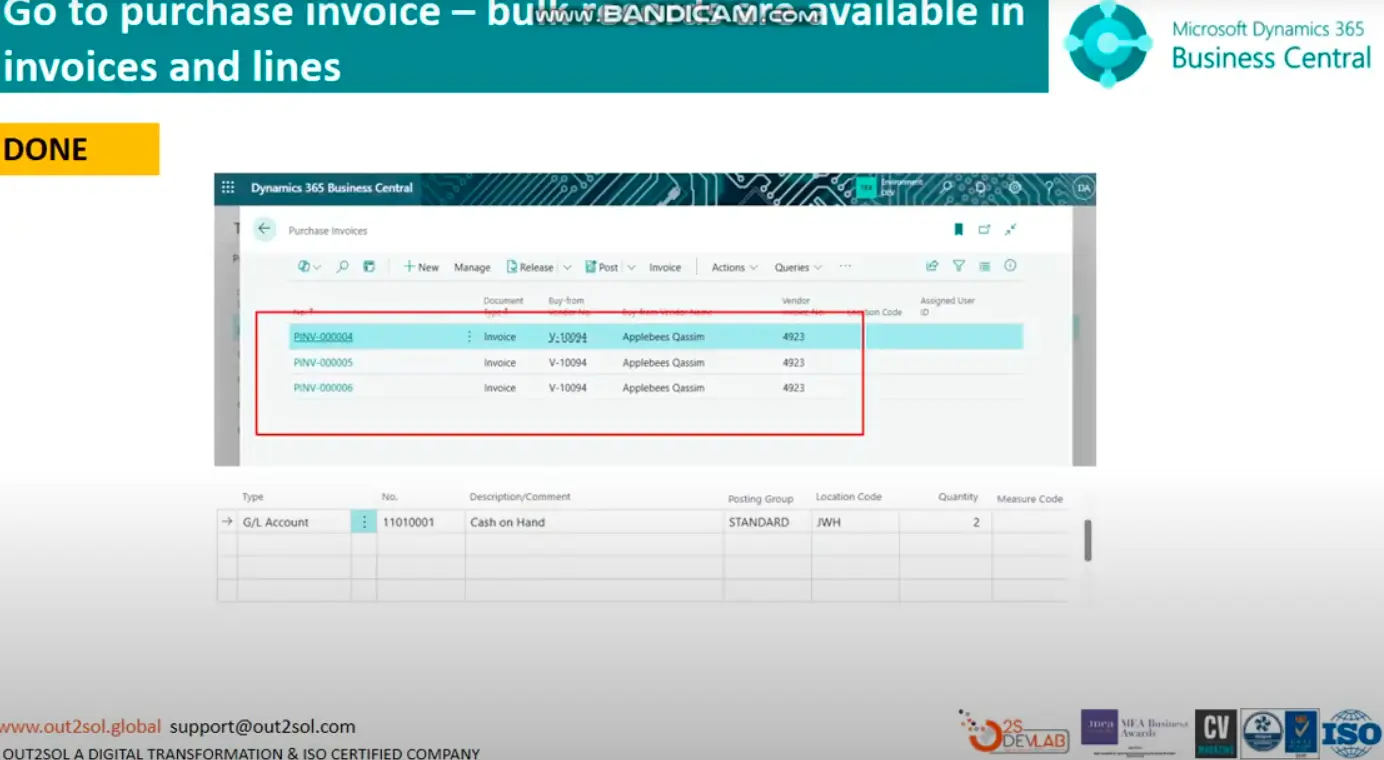

Finally, navigate to Purchase Invoices. You'll see that your bulk records are successfully available in invoices and lines.

Tip: Always review your imported records and run a quick test transaction to confirm the data behaves correctly.

Practical Tips and Tricks

- Backup before import: Always back up your company data before applying packages.

- Use small test packages: Test with 2–3 records before large imports.

- Validate fields first: Use the validation feature to catch mapping errors early.

- Keep Excel clean: Avoid formulas, merged cells, or hidden columns in your Excel sheet.

- Save templates: Reuse configuration packages for recurring imports.

Final Notes

You've now learned how to import data using configuration packages in D365 Business Central, from creating the package to applying it and verifying results.

In our next session, we'll continue exploring How to Connect Your Business Central with Visual Studio. Until then, practice these steps with your sample data and note down any issues you encounter, we'll discuss them together in the next class.

Disclaimer: All logos, trademarks, and brand names used in this document are the property of their respective owners. Their use here is for identification purposes only and does not imply endorsement.

How to Set Up a New Number Series in Dynamics 365 Business Central

In Microsoft Dynamics 365 Business Central, managing number series is one of the most essential tasks for maintaining order and consistency across transactions. Every record in the system, whether it is an invoice, sales order, purchase transaction, or general journal entry, is identified with a unique number. These numbers are generated automatically through number series, making it easier to track and manage business data without duplication or confusion. Companies that implement Microsoft Dynamic 365 solutions often find it easier to automate numbering and reduce errors.

In this training class 2, we will walk through the complete process of creating, setting up, and assigning number series in Business Central.

What is a Number Series in Business Central

A number series in Business Central defines how numbers are assigned to documents and records. Instead of manually entering numbers every time, you can automate the process. This ensures:

- Consistency across different modules

- Control over record sequencing

- Error reduction by avoiding duplicates

- Flexibility for different departments such as finance, sales, and purchasing

For example, a No. Series in Dynamics 365 Business Central might start with INV-10001 for invoices and PO-20001 for purchase orders.

Steps to Create a New Number Series in Business Central

Here’s a detailed, step-by-step process to set up a new number series in Dynamics 365 Business Central:

1. Open the No. Series Page

- In the search bar, type No. Series, then select the No. Series page.

- You will see the list of existing number series codes.

2. Click New to Define a Series

- Click on New.

- Enter a Code (this is shorthand like “INV23”, “PO2025”, etc.).

- Enter a Description so that you (and others) know what it is for (e.g. Sales Orders 2025, Purchase Transactions).

3. Define No. Series Lines

- After creating the number series, click Lines (or similar) to open No. Series Lines.

- Set the Starting Number (e.g. INV-10001).

- Optionally set an Ending Number (e.g. INV-99999) if you want a capped range.

- Enter Starting Date if this sequence should start from a specific date.

- Set Increment-by-No. (often 1, so each new record gets the next number).

4. Configure Default vs Manual Numbering

- Turn on Default Nos if you want Business Central to automatically assign the next number.

- If you need to allow users to override or manually enter numbers (for special cases), enable Manual Nos.

5. Save and Close

Here is a detailed video guide that visually explains the setup process of number series in Dynamics 365 Business Central.

How to Assign a Number Series to Batches and Transactions

Once your number series is created, you must tell Business Central where it should be used. Here’s how:

- For General Journal, Payment Journal, Cash Receipt Journal, open the relevant journal.

- Go to Edit List or batch setup.

- In the No. Series column for the default batch (or other batches), select your newly created number series.

- Now, when new entries are created in that batch, numbers will follow the series.

It applies similarly for sales and purchase transactions (Sales Orders, Purchase Orders, Sales Invoices, etc.) via the relevant setup areas (e.g. Sales & Receivables Setup, Purchases & Payables Setup).

How to Set Up Number Series for EFT Transactions

Electronic Funds Transfer (EFT) transactions often need a separate numbering sequence:

- Open the Bank Account Card for the bank account that performs EFT.

- Fill the EFT Number Series field with your specific EFT code (e.g. “EFT-2025”).

- Make sure this EFT series does not overlap with your regular payment journal series.

- When you generate remittance advice or EFT payments, the system will use this dedicated number series automatically.

Difference Between EFT and Regular Number Series

|

Feature |

Regular Number Series |

EFT Number Series |

|---|---|---|

|

Used for |

Invoices, Journals, Sales / Purchase Transactions |

Electronic payments & EFT entries |

|

Assignment |

Through transaction setup or batch setup |

In Bank Account Card or EFT setup |

|

Overlap |

Usually shared among multiple modules |

Isolated for clean tracking |

|

Visibility |

Always visible in document headers / journals |

Only used when EFT process is invoked |

How to Change a Number Series for Any Master Record

Sometimes, businesses need to update their numbering rules, especially when entering a new financial year. For example, invoice numbers may restart from 10001 each January.

- To change a number series:

- Open the master record setup (e.g., Sales & Receivables Setup).

- Find the field No. Series.

- Replace it with the newly created series (e.g., SALES2025).

Business Central will then automatically generate numbers using the new sequence for all future records.

Common Issues and Best Practices

- Running out of numbers: Ensure your ending number is far enough ahead. Use reminders or warning when numbers approach end.

- Continuous vs Gaps: For financial / audit-critical documents, avoid gaps. For non-critical records (quotes, warehouse docs), gaps may be permissible.

- Manual override: Be careful when allowing manual numbers — ensure uniqueness and avoid duplicates.

- Date order vs number order: If you post out of work date order, Business Central might flag issues if number series line dates conflict.

Visualizing the Number Series Flow

Below is a simple flowchart that explains how number series work in Business Central:

Transaction Created → System Checks Assigned Number Series → Number Generated → Record Saved

This flow ensures that every transaction is automatically linked to the correct numbering rules.

Expanded Detail: No. Series Fields Overview

To help you understand all the settings you might see, here is more detail on fields and what they mean:

|

Field |

What It Does |

Important Notes |

|---|---|---|

|

Code |

The identifier of the number series |

Keep it meaningful (e.g. “SO2025”, “PO_INV”) |

|

Description |

What this series is for |

Helps others know purpose at a glance |

|

Ending No |

Optional limit |

Prevents series overflow |

|

Increment-by-No |

Usually 1 |

Can be higher if skipping numbers (rare) |

|

Manual Nos |

Allows user override |

Turn on only when needed |

|

Default Nos |

Makes BC auto-assign next number |

Good for documents where manual entry is rare |

|

Starting Date |

When this line becomes active |

Helpful if using multiple lines with timeline splits |

Summary

Setting up a number series in Business Central is essential for keeping financial and operational records organized. By creating unique series for invoices, purchase orders, general journals, and EFT transactions, businesses can maintain control and accuracy. With a few simple steps, administrators can create, assign, and update these sequences as business needs evolve.

With Microsoft Dynamic 365 solutions, the process becomes flexible and efficient. From defining a new number sequence to managing exceptions like EFT transactions, Business Central ensures every record is properly numbered.

If you want a hands-on walkthrough, don’t forget to watch our training video on Set Up a New Number Series in Dynamics 365 Business Central. This is the second lesson in our Microsoft Dynamics 365 training series, so stay tuned for the next session.

Disclaimer: All logos, trademarks, and brand names used in this document are the property of their respective owners. Their use here is for identification purposes only and does not imply endorsement.

%20in%20D365%20Business%20Central.webp)

How to Setup Multifactor Authentication (MFA) in D365 Business Central

Security in today’s digital environment is no longer optional; it is a necessity. Many organizations rely on Microsoft Dynamic 365 solutions to manage their operations, finance, and customer data, which makes protecting these systems a top priority. One of the most reliable ways to safeguard access is by enabling Multifactor Authentication in D365 Business Central. This blog will guide you step by step on how to set up MFA, explain the different authentication methods available, and show why it is essential for every business.

Why You Must Use Multifactor Authentication to Access Business Central

Traditional password protection is no longer enough. Cyber attackers use advanced methods to crack weak or reused passwords, and even the strongest credentials can be compromised through phishing or brute-force attacks. This is where MFA in D365 Business Central becomes vital.

With Business Central MFA, users are required to provide an additional verification step beyond the standard password. This could be a phone call, text message, or mobile authenticator app notification. Adding this second layer of defense ensures that even if a password is stolen, unauthorized access is nearly impossible.

If you want to see this process visually, check out our detailed walkthrough in this video tutorial.

Multi Factor Authentication Flowchart

The flow of Multi Factor Authentication methods in Business Central can be understood through a simple process:

- User Login Attempt: A user enters their Business Central credentials.

- System Verification: Business Central checks the username and password.

- MFA Trigger: The system prompts the user to verify their identity using an additional method.

- Authentication Method Selection: The user confirms through their chosen method (app, SMS, email, or hardware token).

- Access Granted: If the verification is successful, the user gains access to Business Central.

- This flow ensures that access is not granted until both steps are verified.

Authentication Methods in Business Central MFA

Here’s a simple breakdown of the available authentication methods in Business Central MFA:

|

Authentication Method |

Description |

Best Use Case |

|---|---|---|

|

Microsoft Authenticator App |

Mobile app providing push notifications or codes |

Recommended for most users (balance of security + ease) |

|

SMS or Phone Call |

A code sent to the user’s registered mobile number |

Useful for users without smartphones |

|

Email Verification |

Code delivered via email |

Works as a backup method but less secure |

|

Hardware Security Key |

A physical key used for verification |

Ideal for high-security environments like finance or government |

As a best practice, most organizations prefer the Microsoft Authenticator App for strong protection and smooth usability.

Step-by-Step Setup of Multifactor Authentication in D365 Business Central

Here is a simplified process to configure MFA in D365 Business Central:

- Sign in to Microsoft 365 Admin Center with your administrator account.

- Go to Users > Active Users.

- Select the user accounts that require MFA.

- Click on Manage Multifactor Authentication.

- Enable MFA for the selected accounts.

- On the next login, users will be prompted to configure their preferred authentication method.

- Once completed, MFA will be active for that user in Business Central.

Pro Tip: Roll out MFA in phases—start with high-privileged accounts like admins, then extend it to all employees.

Benefits of Enabling Business Central MFA

- Improved Security: Protects against stolen or hacked credentials.

- Regulatory Compliance: Meets data security standards required in many industries.

- Scalability: Works across enterprises of all sizes, from SMEs to large corporations.

- User Confidence: Employees can work remotely without worrying about account breaches.

Summary

Setting up Multifactor Authentication in D365 Business Central adds an extra security layer beyond passwords and helps protect your company data from unauthorized access. With Microsoft Dynamic 365 solutions, this setup can be done through the admin center where you enable MFA for users, choose the preferred authentication methods, and enforce login policies. Once enabled, users must verify their identity through options like an authenticator app, SMS, or email codes before accessing Business Central. This makes it harder for attackers to gain access, even if a password is compromised.

To follow along with a hands-on demonstration, don’t forget to watch our training video on setting up MFA in Business Central. This will be the first class in our Microsoft Dynamics 365 training series, so stay tuned for more tutorials.

Disclaimer: All logos, trademarks, and brand names used in this document are the property of their respective owners. Their use here is for identification purposes only and does not imply endorsement.